http://economicedge.blogspot.com/2009/08/martin-armstrong-will-gold-reach-5000.html

Armstrong believes that gold is NOT a hedge against inflation but rather a hedge against a loss of confidence in government. There is a difference, and Martin does a good job explaining it. He is reiterating his latest papers in stating that a loss of confidence in the government sector is coming soon if not here already.

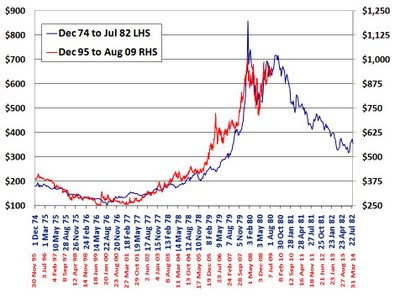

He gives a complete technical update for gold stating:

“I have provided the technical analysis on Gold based on a monthly chart. The first real resistance is formed by the Primary Channel that shows $1,350 - $1,750 between 2010 and 2012. this represents still a plain old normal technical move with nothing that would reflect a meltdown. It is breaking this overhead resistance where it becomes support that we enter in the “danger zone” of a true meltdown in PUBLIC CONFIDENCE.

Most of the projected resistance from the major low back in 1999, shows various targets from $1,700 to $2,750. However, if gold exceeds this level and it too forms the subsequent support, now we are looking at the $3,500 to $5,000 target zone. This is where we see the potential for Gold is a true economic meltdown of CONFIDENCE.”

http://fofoa.blogspot.com/2009/08/no-free-lunch.html

Here is the problem though, kids. Most mature investors retain their life savings fully invested within the financial industry, denominated in dollars, and will not get off these tracks even when they see the train coming. They will stay there because it is impossible for them to believe they occupy the wrong position! Who can blame them or call them fools? They have been trained their whole life to believe in saving for the future inside of a monetary system that serves no purpose other than as a medium of exchange.

Worse, they perceive that all of their assets are correctly valued by this system that does not care about the value of a digit. How can they possibly be correctly valued in a system that only functions properly as a medium of exchange, not a store of value? How can assets meant to be stores of value be correctly valued when denominated in a unit whose value DOESN'T EVEN MATTER in the context of its primary function? They can't. They shouldn't. They aren't. And soon this FACT will be known by everyone.

Armstrong believes that gold is NOT a hedge against inflation but rather a hedge against a loss of confidence in government. There is a difference, and Martin does a good job explaining it. He is reiterating his latest papers in stating that a loss of confidence in the government sector is coming soon if not here already.

He gives a complete technical update for gold stating:

“I have provided the technical analysis on Gold based on a monthly chart. The first real resistance is formed by the Primary Channel that shows $1,350 - $1,750 between 2010 and 2012. this represents still a plain old normal technical move with nothing that would reflect a meltdown. It is breaking this overhead resistance where it becomes support that we enter in the “danger zone” of a true meltdown in PUBLIC CONFIDENCE.

Most of the projected resistance from the major low back in 1999, shows various targets from $1,700 to $2,750. However, if gold exceeds this level and it too forms the subsequent support, now we are looking at the $3,500 to $5,000 target zone. This is where we see the potential for Gold is a true economic meltdown of CONFIDENCE.”

http://fofoa.blogspot.com/2009/08/no-free-lunch.html

Here is the problem though, kids. Most mature investors retain their life savings fully invested within the financial industry, denominated in dollars, and will not get off these tracks even when they see the train coming. They will stay there because it is impossible for them to believe they occupy the wrong position! Who can blame them or call them fools? They have been trained their whole life to believe in saving for the future inside of a monetary system that serves no purpose other than as a medium of exchange.

Worse, they perceive that all of their assets are correctly valued by this system that does not care about the value of a digit. How can they possibly be correctly valued in a system that only functions properly as a medium of exchange, not a store of value? How can assets meant to be stores of value be correctly valued when denominated in a unit whose value DOESN'T EVEN MATTER in the context of its primary function? They can't. They shouldn't. They aren't. And soon this FACT will be known by everyone.